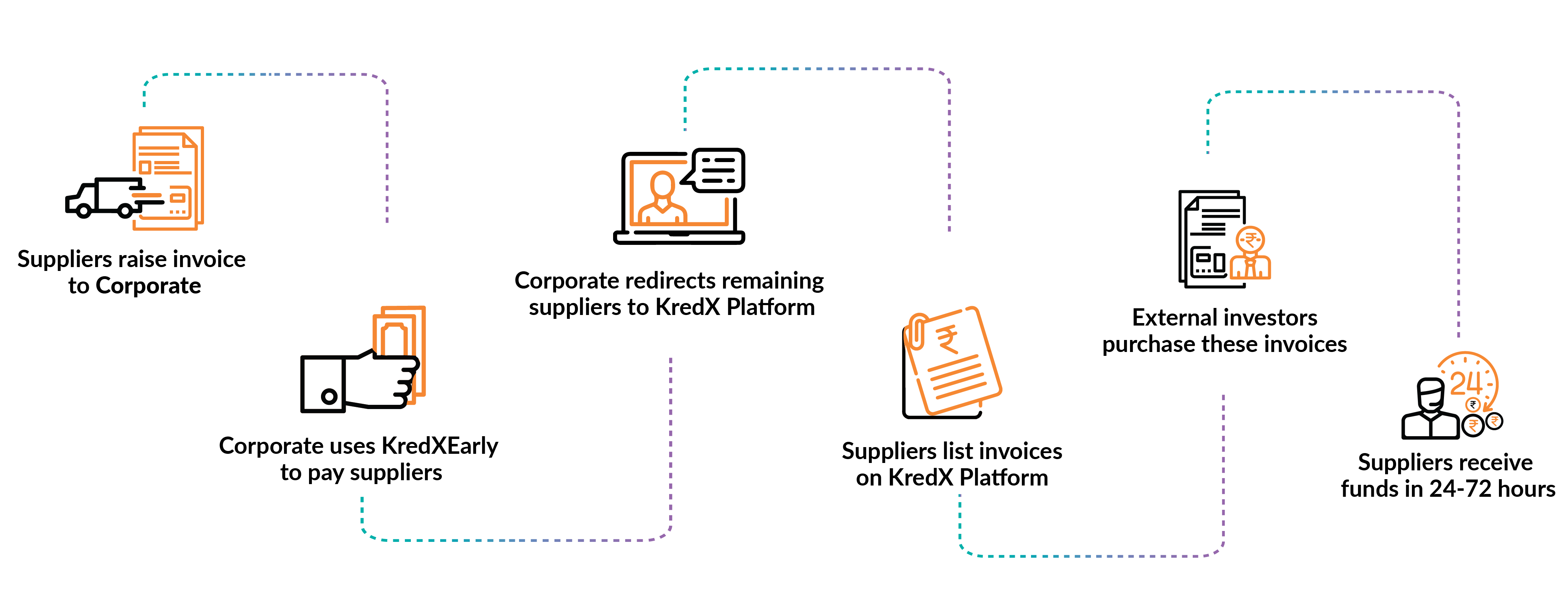

How KredX Early works

Earn high returns at ZERO risk as opposed to other investment options available in the market that yield low returns at low risk or high returns at high risk.

KredX provides a holistic cash flow ecosystem for corporates

by bridging the gap between payables, receivables and their financing needs.

You don't have to part with your valuable assets anymore. Use unpaid invoices to get funds for your business and help it grow.

Sign up on KredX & upload your invoices to get access to working capital in 24-72 hours to ensure a healthy cash flow.

To save your business time & effort, we provide a paperless, digital process and complete transparency every step of the way.

With the help of Invoice discounting, KredX has helped over 3000 SME and MSMEs in India

KredX has successfully discounted over 2,00,000 blue-chip invoices to solve cashflow issues of businesses

KredX offers invoice discounting services to business all over India.

KredX Early is an online technology solution that helps suppliers receive early payments through the use of cutting-edge technology and algorithms.

16% average yield which is 50% higher than standard market products

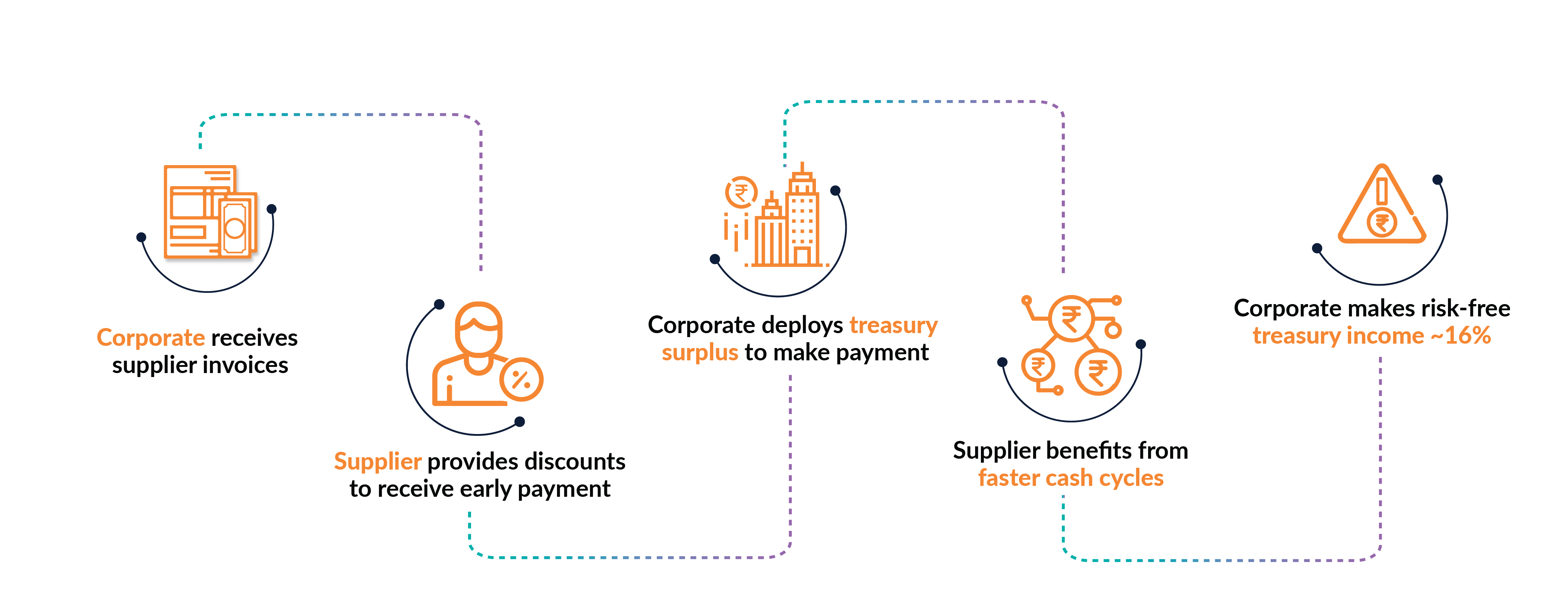

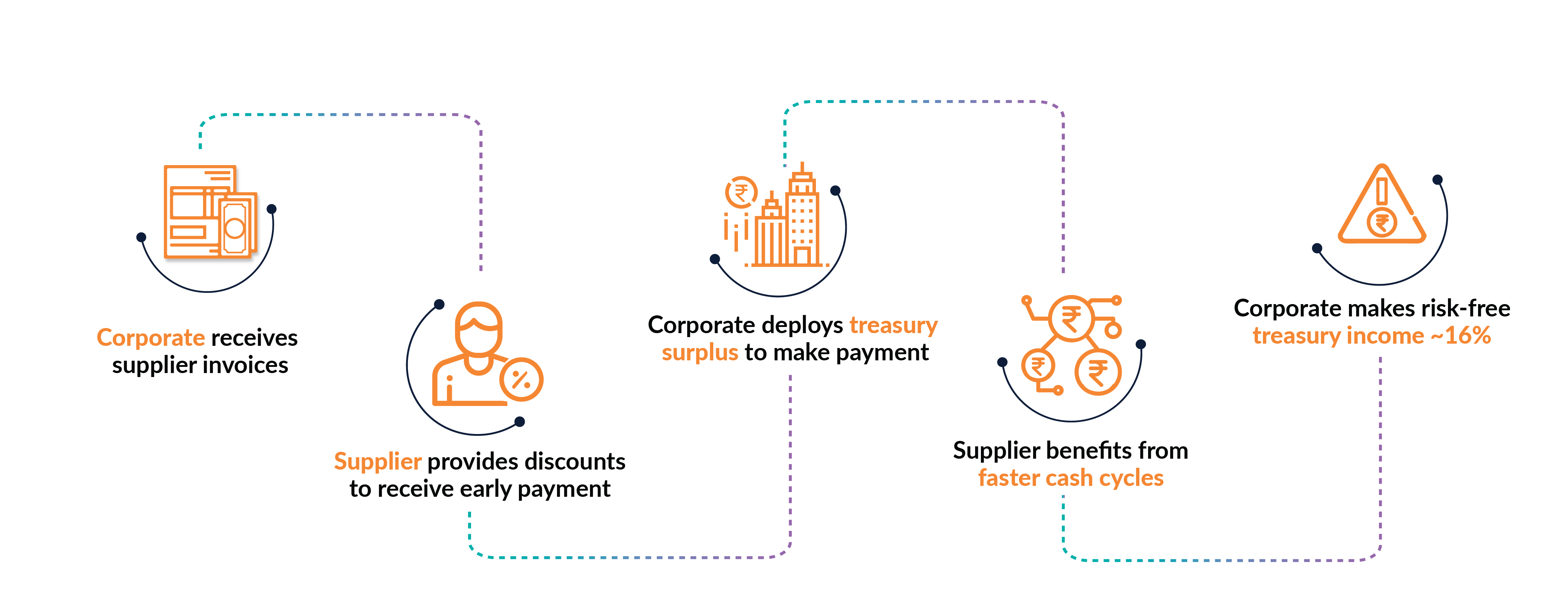

Deploy surplus funds for early payments at a discount to earn risk-free high returns.

Corporates can choose to deploy their treasury surplus into KredX Early to gain the returns of their choice

KredX platform has ability to give you advance analytics and reports

Enables aggregation across locations offering corporates complete control at the click of a button anytime, anywhere

Complete supplier satisfaction as KredX Early helps improve their operational cash flow through early payments

Through dynamic discounting, KredX till date has approx. 60+ corporates on Platform

Since KredX Early is a cloud-based solution that can be accessed anytime, anywhere, corporates across the globe can utilise our product

Earn high returns at ZERO risk as opposed to other investment options available in the market that yield low returns at low risk or high returns at high risk.

CEO Manish Kumar won the 'Entrepreneur of The Year' in Business Services - Money Services at the 7th Annual Entrepreneur India Awards 2017

KredX was featured among the top 100 leading global Fintech innovators in the KPMG-H2 Ventures 2017 Fintech100 list

KredX was among the top 50 ventures in The Smart CEO-Startup50 India 2016 Program

Sutra HR’s Top 100 Startups to Watch in 2017

Manish Kumar Founder & CEO Manish is an IIT Kanpur alumnus with over a decade of experience in the banking and financial industry. He was previously Associate Director at Capital One, before which he was heading Credit Risk Acquisition division at HSBC.

Anurag Jain Co-founder & COO An IIT Kanpur alumnus, with several years of experience with Oracle and HSBC where he was Assistant Vice President of Decisioning Technology. Anurag went on to join his family business which he successfully ran for over two years before founding KredX.

PVP is one of India’s leading seed-stage venture capitals that has helped a number of category-creating, technology-driven startups with funding and mentoring till date.

Established in 1972, Sequoia Capital is a global venture capital firm that has previously funded some of the most legendary companies such as Apple, Google, Oracle, PayPal, YouTube, Instagram, Yahoo! and WhatsApp.